How to Set Up Zakat Deduction in Payroll BrioHR

Learn what Zakat tax relief is and how to set up Zakat deductions in BrioHR Malaysia payroll. This guide covers setting up Zakat deductions in employee profile and adding zakat deduction during a payroll process.

What is Zakat Tax Relief?

Zakat is an Islamic form of charitable giving that may be deducted from employee's payroll in certain countries. In BrioHR, employers can easily manage Zakat deductions during payroll processing and choose whether to apply them one-time or recurring deductions.

BrioHR supports multiple ways to add Zakat deductions to monthly payroll , providing flexibility for both employers and employees.

Ways to Add Zakat Deduction in BrioHR

In BrioHR, there are two (2) main ways to add Zakat deductions to payroll:

Option A: Set a Custom Zakat Amount in the Employee's Payroll Profile (Recurring)

- Ideal for employees with a fixed monthly Zakat contribution

- Automatically deducted during every payroll cycle

Option B: Add Zakat During a Payroll Run (One-Time or Recurring)

- Suitable for one-time or adjustable Zakat deductions

- Can be set as recurring during payroll processing

Important Prerequisite: Enable Zakat in Payroll Center's Settings

Before proceeding, ensure Zakat is enabled in your Payroll Center General Settings.

Why This Matters?

- If Zakat is disabled, any pre-set Zakat amount in an employee's profile will not appear during payroll processing.

For how to enable 'Zakat' in payroll center general settings, please refer to this video:

1. Go to HR Lounge > Payroll Center

2. Open the Settings tab > General > Registration Information

3. Find the Organization field > Click the drop-down list > Select Zakat

4. Click Save

Step-by-Step Process to Add Zakat in Payroll

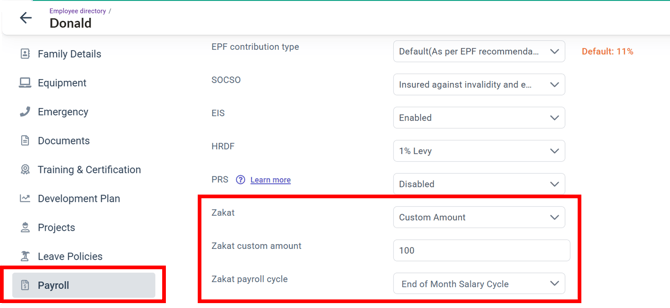

A) Set Custom Zakat Amount in Employee's Profile Payroll

This latest feature allows HR or Admin users to pre-set a custom Zakat amount in an employee's profile so it automatically deducted every payroll month.

You can also decide which payroll cycle this deduction will happen if the employee is processed in more than two (2) cycles in a month.

Step 1 - Login to BrioHR Account

Log in using you registered credentials.

Step 2 - Access an Employee's Profile Payroll

1. Go to HR Lounge > Employee Management.

2. Search for the employee in the Employee List.

3. Click the employee's name to open their profile.

4. Navigate to the Payroll tab.

Step 3 - Add a Custom Zakat Amount

1. Under the Statutory Contributions section, click the pencil (edit) icon.

2. Locate the Zakat field.

3. Select Custom Amount from the dropdown.

4. Enter the Zakat amount.

5. Select the payroll cycle from which the deduction should begin.

6. Click Save.

TIPS:

- Always select the payroll cycle under which the basic salary or any cycle that has remuneration.

- If basic salary is split across multiple cycles, Zakat cannot be split accordingly.

- If you select more than one payroll cycle for Zakat deduction amount RM 200, this RM200 will appear in both payroll cycles and it won't split RM 100 for each cycle.

NOTES:

- The pre-set deduction will appear in payroll as "Zakat (Deducted From Payroll)"

- Currently, you can set a custom Zakat amount on an individual employee profile basis. Bulk setup via employee payroll details upload is not supported at this time.

- Pre-set custom Zakat amounts are also not supported for Ad-Hoc payroll cycles. If you need to apply a Zakat deduction in and Ad=Hoc cycle, please add it manually by following Option B below,

B) Adding Zakat in Payroll During A Payroll Process

You can also add Zakat deduction directly while processing payroll. This method supports both one-time and recurring deductions.

This is the existing method for adding Zakat before the latest enhancement explained in Option (A).

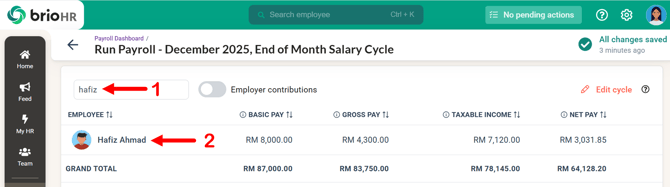

Step 1 - Access the Payroll Dashboard

1. Go to HR Lounge > Payroll.

2. Click Run Payroll to start the payroll cycle.

Step 2 - Select the Payroll Cycle

1. Choose the payroll cycle and click Start.

2. You will be directed to Stage 1 - Adjust Payroll.

Step 3 - Select the Employee

Locate the employee you wish to add the Zakat deduction and expand their payroll row.

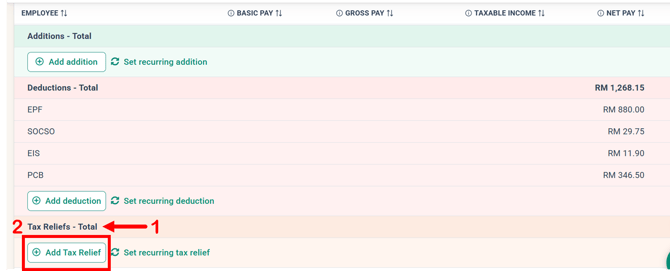

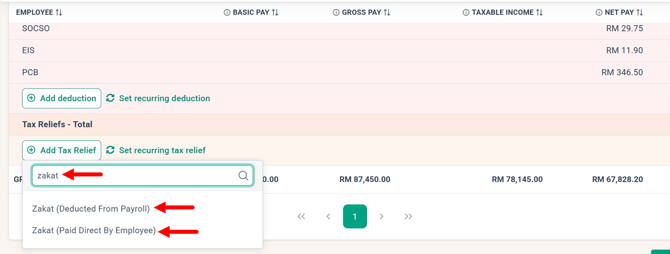

Step 4 - Add Zakat Under Tax Relief Section

1. Locate the Tax Relief section.

2. Click +Add Tax Relief button.

3. Search for Zakat.

Step 5 - Choose Zakat Deduction Type

- Zakat (Deducted From Payroll):

The company deducts from the employee's payroll and pays Zakat on behalf of the employee - Zakat (Paid Directly by Employee):

The employee pays the Zakat directly without direct deduction from payroll, declared for PCB/MTD reduction purposes.

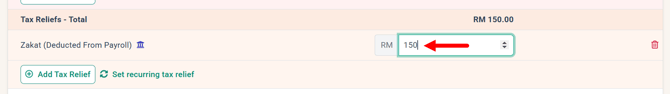

Step 6 - Enter the Zakat Amount

Input the amount and click Continue.

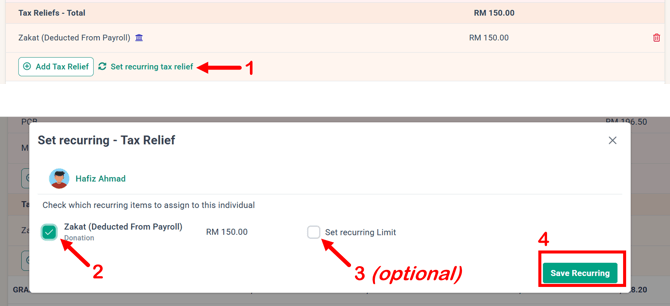

Step 7 - (Optional) Set Recurring Zakat Deductions

If the Zakat deduction needs to recur, click on Set Recurring Tax Relief.

1. Check the box for Zakat.

2. If applicable, check Set Recurring Limit and enter the number of times the Zakat deduction should recur.

3. Click Save Recurring to confirm.

NOTES:

- If no recurring limit is set, the Zakat deduction will continue until manually removed.

- Recurring Zakat will automatically appear in future payroll cycles.

LEARN MORE:

Frequently Asked Questions (FAQs)

1. Can Zakat be set as a recurring deduction?

Yes, Zakat can be set as a recurring deducting either in the employee's profile payroll or during a payroll run.

2. What is the difference between "Zakat Deducted From Payroll" and "Zakat Paid Directly by Employee"?

- Deducted From Payroll: The company deducts and pays Zakat on behalf of the employee.

- Paid Directly by Employee: No deduction is made as the employee pays Zakat outside of payroll. The amount is declared for tax relief purposes only.

3. Why doesn't Zakat appear during payroll processing after adding in the employee's profile payroll?

Please ensure that Zakat is enabled under Payroll Center General Settings. You can take a look at the beginning section of this article for the how-to.

4. How does Zakat deducted from payroll work?

When Zakat is deducted from payroll, the company is responsible for processing the payment to the Zakat organization on behalf of the employee.

5. Will Zakat affect PCB (Monthly Tax Deduction)?

Yes, Zakat declared in payroll can reduce the employee's PCB amount.

Need Assistance?

If you have any questions or require assistance, please reach out to our support team via live chat or email us at support@briohr.com.