How to Use the LHDN Calculator to Accurately Calculate PCB

Quick and Easy Guide to Calculate Malaysian Employee Tax Using the Official LHDN Calculator. Learn how to accurately calculate the monthly tax for employees in Malaysia, whether they are newly hired or previously employed.

The BrioHR payroll system complies with LHDN tax specification files, and the monthly tax deduction (MTD/PCB) is automatically calculated based on these specifications.

If you would like to understand how the system calculates an employee's tax and see the calculation breakdown, you can use the LHDN calculator.

Accessing the Tax Calculation Tool

1. Access the LHDN Tax Calculation Tool:

- Go to the website (under the MyTax Portal > Perkhidmatan Ezhasil) 2025 PCB Calculation calculator: https://calcpcbplus.hasil.gov.my/HITS_CE/?lang=BM

2. Choose the Relevant Option:

- PREVIOUSLY EMPLOYED IN CURRENT YEAR:

- For existing employees or newly hired employees who were employed with another company anytime between January and the current month.

- Note: For new hired employees, the accumulated remuneration (including from previous employer) is their TP3 form amount.

- PREVIOUSLY NOT EMPLOYED IN CURRENT YEAR:

- For newly hired employees who have not been employed in the current year (and without TP3 form amount)

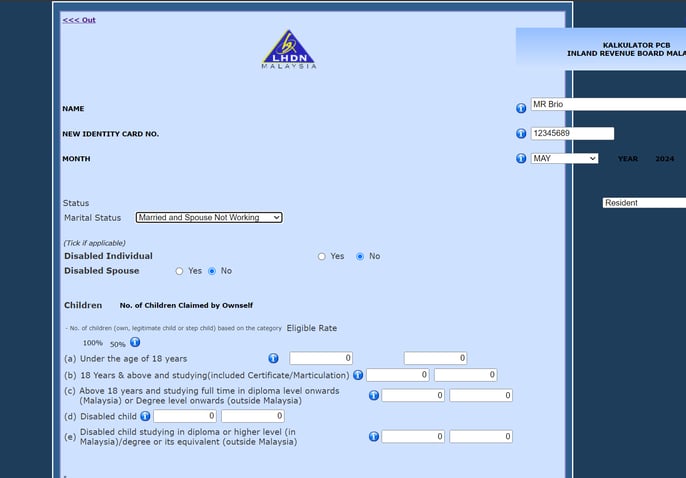

Guide for PREVIOUSLY EMPLOYED IN CURRENT YEAR

Step 1:Select the current month under the "Month" dropdown.

Step 2:

Fill in the employee’s tax information such as:

- Status

- Marital Status

- Is the employee a disabled individual

- Is the spouse of the employee is disabled

- Number of children claimed by the employee

Step 3:

Fill in the section:

"ACCUMULATED REMUNERATION/MTD/REBATE/DEDUCTION UNTIL BEFORE CURRENT MONTH FOR CURRENT YEAR (INCLUDING FROM PREVIOUS EMPLOYER)" with the total amounts for earnings, rebates, and deductions from January to the last month.

- Total taxable income under 'Accumulated remuneration/BIK/VOLA

- Accumulated EPF and other Approved Funds - maximum RM 4000 (if an employee's employee EPF contribution exceeds RM 4000, just input RM 4000)

- Accumulated MTD/PCB paid

- Accumulated zakat/fitrah paid (if any)

- Accumulated levy paid (if any)

- Other accumulated deductions (description of TP1 Form Note 2024) (if any)

Step 4:

Enter the current month's details at 'CURRENT MONTH'S REMUNERATION' section:

- Salary and Fixed Remunerations (total income of taxable fixed/normal remunerations) under CURRENT MONTH'S REMUNERATION

- Current month's EPF under CURRENT MONTH'S REMUNERATION

- Additional Remunerations (total income of taxable additional remunerations) under CURRENT MONTH'S ADDITIONAL REMUNERATION

- Deductions (description of TP1 Form Note 2024) under CURRENT MONTH'S DEDUCTION.

- Rebates (e.g., Zakat/Fitrah) under CURRENT MONTH'S REBATE INFORMATION.

Step 5:

Click on Calculate. The site will generate the tax payable for the current month and the total MTD per year.

It will show the MTD amount for every month until December if there is no changes on remuneration, deduction and rebate!

Step 6:

Click on Print HTML/PRINT PDF to view the tax breakdown and calculation.

Step 7:

If needed, click on Update to adjust the current month's data.

Step 8:

To estimate tax for the upcoming month, click on Calculate Next Month.

Guide for PREVIOUSLY NOT EMPLOYED IN CURRENT YEAR

Step 1:

Select the current month under the "Month" dropdown.

Step 2:

Fill in the employee’s tax information such as "Status", "Marital Status", etc.

Step 3:

Enter the current month's details at 'CURRENT MONTH'S REMUNERATION' section:

- Salary and Fixed Remunerations (total income of taxable fixed/normal remunerations) under CURRENT MONTH'S REMUNERATION

- Current month's EPF under CURRENT MONTH'S REMUNERATION

- Additional Remunerations (total income of taxable additional remunerations) under CURRENT MONTH'S ADDITIONAL REMUNERATION

- Deductions (from TP1 Form) under CURRENT MONTH'S DEDUCTION.

- Rebates (e.g., Zakat/Fitrah) under CURRENT MONTH'S REBATE INFORMATION.

Step 4:

Click on Calculate. The site will generate the tax payable for the current month.

Step 5:

Click on Print HTML/PRINT PDF to view the tax breakdown and calculation.

Step 6:

Click on Update to adjust the current month's data if needed.

Step 7:

Click on Calculate Next Month to estimate tax for the next month.

NOTE:

For more detailed tax calculations, you are encouraged to start from January if you want an overview of the monthly payable tax.

Need Assistance?

If you have any questions or require assistance, please reach out to our support team via live chat or email us at support@briohr.com.