Payroll Malaysia: Complete Guide to Setting Up Company Payroll Information

Learn how to properly set up your company’s payroll general settings in BrioHR, including registration details, bank information, salary proration, statutory setup, payslip settings, and more. Includes step-by-step instructions and FAQs.

Introduction

Setting up your company payroll information is one of the most important steps when creating a new payroll center in BrioHR. This stepup includes essential details such as:

- Company registration and statutory information

- Bank account details

- Salary proration and calculation rules

- Payslip visibility settings

IMPORTANT:

Incomplete Payroll General Settings can cause issues when processing monthly payroll and accessing payroll documents.

This guide walks you through each section step-by-step to ensure your Malaysia payroll center is correctly configured

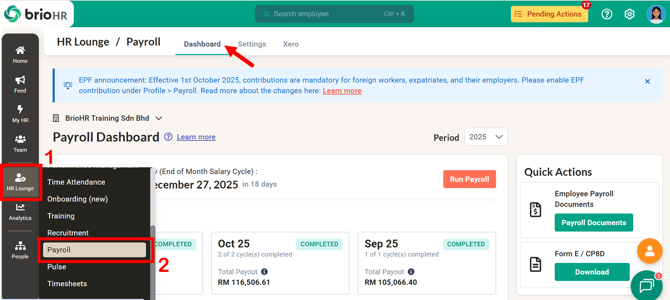

How to Access Payroll General Settings

Step 1 - Log in to your BrioHR Account

Step 2 - Navigate to Payroll

1. Click HR Lounge.

2. Select Payroll.

You will be directed to the Payroll Dashboard.

Step 3 - Go to Settings

1. Click Settings.

2. Then, select General.

This page must be completed before running payroll.

Overview of Payroll General Settings

The General Settings page is divided into five (5) sections:

- General Information

- Registration Information

- Bank Account

- Calendar

- Payslip Settings (Hide BIK and Auto Release Payslips)

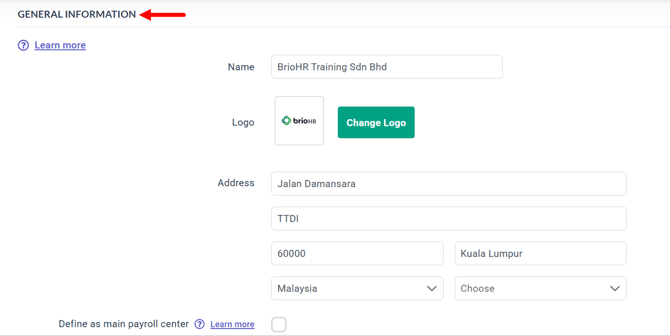

Part 1: General Information

Mandatory fields to complete:

-

Name – Name of your payroll center

-

Logo – Appears on the employee payslip

-

Address – Displays on EA Form, Form E, and other statutory submissions

-

Define as Main Payroll Center – Enable if you want to combine bank and statutory files from multiple payroll centers

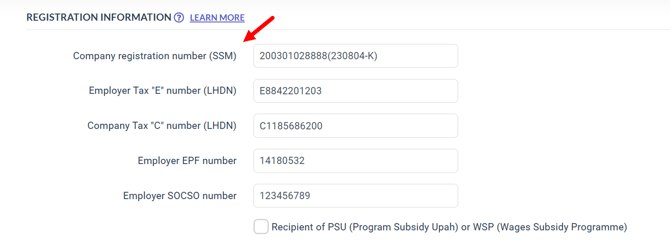

Part 2: Registration Information

Ensure you fill in all mandatory statutory fields:

2.1 Company & Statutory Details

- Company Registration Number (SSM)

- Employer Tax "E" Number (LHDN)

- Company Tax "C" Number (LHDN)

- Employer EPF Number

- Employer SOCSO Number

- If your company is part of the PSU (Program Subsidy Upah) or WSP (Wage Subsidy Programme), select the checkbox below the SOCSO number. Learn more here.

Learn More: Understanding E Number, C Number, EPF Number, and SOCSO Number in Malaysia : A Complete Guide

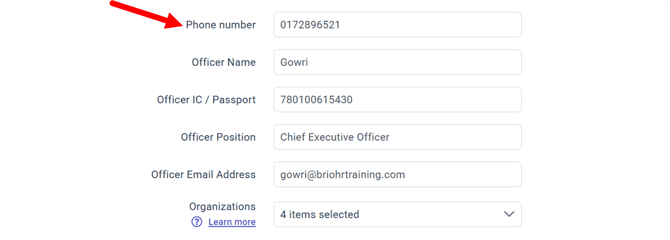

2.2. Officer Details (Maklumat Pegawai)

These details appear on statutory documents (EA Form, Form E, CP8D)

- Phone Number -The company or officer’s contact number.

- Officer Name (Nama Pegawai): The name of your payroll officer. If not added, this won't appear in certain payroll documents such as the EA Form, Form E, and CP8D Form.

- Officer IC or Passport Number

- Officer Position

- Officer Email Address

Learn More: How to Update Officer Details (Maklumat Pegawai) in EA Form and E Form in Malaysia Payroll

2.3. Organizations (Statutory Body Selection)

Choose the statutory bodies your company contributes to:

- EPF

- SOCSO

- EIS

- HRDF

- PRS (Private Retirement Scheme)

IMPORTANT:

If the statutory bodies are not selected, these statutory deductions will NOT appear during payroll runs.

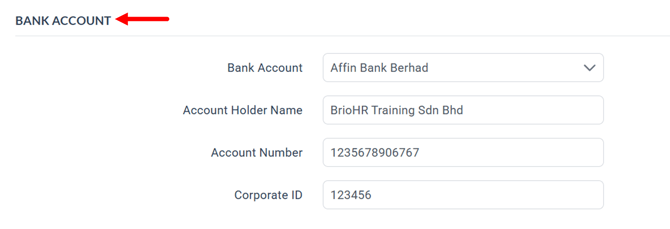

Part 3: Bank Account

Make sure the following required fields are completed:

- Bank Account - Select the correct company bank (e.g., Malayan Banking Berhad for Maybank)

- Account Holder Name

- Account Number

This is the account used for salary reimbursements.

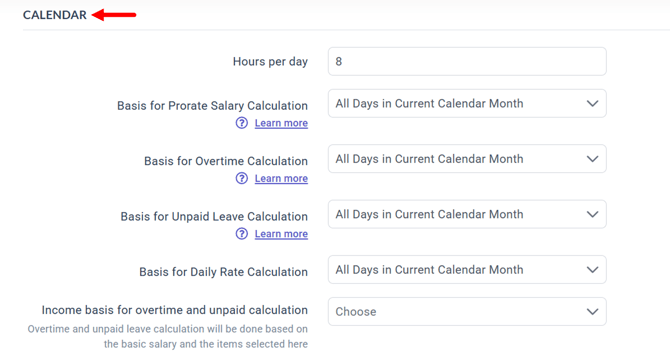

Part 4: Calendar

These fields determine how salary, overtime, unpaid leave, and daily rates are calculated.

- Hours per Day: Standard working hours.

- Basis for Prorate Salary Calculation: Choose the formula your company uses for calculating salary proration. Refer to this article for more info.

- Basis for Overtime Calculation: Formula for calculating overtime rate. Refer to this article for more info.

- Basis for Unpaid Leave Calculation: Formula for calculating unpaid leave. Refer to this article for more info.

- Basis for Daily Rate Calculation: Formula for calculating rate for pay item following unit type "Day" type. Refer to this article for more info.

- Income Basis for Overtime and Unpaid Leave Calculation: Overtime and unpaid leave calculations will be based on the basic salary and the items selected here (optional, see explanation below).

Explanation:

If your overtime and unpaid leave calculations are based on basic salary + <additional pay item>, select the additional pay item here.

Example:

If you calculate Overtime and Unpaid Leave based on:

Basic Salary + Travel/Petrol Allowance (For official duties),

then, select the relevant pay item in this field

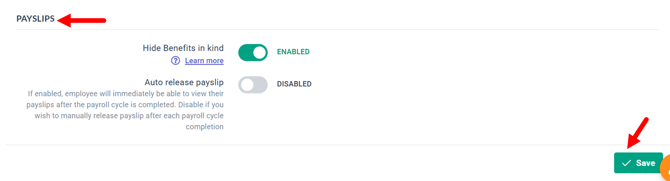

Part 5: Payslip Settings

This section controls how information appears on employee payslips.

- Hide benefits in kind (BIK)

- Auto Release Payslip

5.1. Hide Benefits in Kind (BIK)

Enable this if you want BIK items to be hidden from the payslip. However, they will still appear in payroll reports of the payroll month you have added the BIK items.

Learn More: How to Hide Benefits-in-Kind on BrioHR Payslips

5.2. Auto Release Payslip

- When enabled:

Employees can view their payslip immediately after payroll is confirmed. - When disabled:

Admins can manually schedule or release payslips.

Once all fields are completed, click Save to apply the changes.

Frequently Asked Questions (FAQs)

1. What happens if I skip a mandatory field?

Missing information may prevent payroll from being processed or statutory files from being generated.

2. Can I update payroll settings after running payroll?

Yes, but it is recommended to update settings before starting the payroll cycle.

3. Why are my statutory calculations not appearing during payroll?

You may have forgotten to select the statutory organizations (EPF, SOCSO, EIS, HRDC)

4. Why is the wrong bank file generated?

Ensure you selected the correct bank that your company uses for salary payment.

5. Can I hide only certain BIK items from payslips?

No, the Hide Benefits-in-kind hides all BIK items from the payslip.

Need Assistance?

If you have any questions or require assistance, please reach out to our support team via live chat or email us at support@briohr.com.